Not long after the Khmer Rouge fell from power, Val Kuchphalla’s parents settled into a crumbling third-floor apartment in downtown Phnom Penh that they shared with several other families and a herd of pigs.

The animals provided a way to earn income at a time when money-making opportunities were scarce. The country was just beginning to rebuild. Most schools remained closed, cars were a rare sight, and a barter system based on rice served as the foundation for most common financial exchanges. Her parents worked long hours, spent frugally and saved wisely.

It was in that environment that Val Kuchphalla was born and raised — and coming of age during those hard-scrabble years instilled in her lifelong lessons on the value of work and money.

Now, as a mother of two, it’s those lessons that she instinctively passes on to her son and daughter.

“We love our children, and we do not regret giving them money,” says the 41-year-old homemaker, who maintains the family’s finances. “But we have our conditions.”

Spreading the Wealth

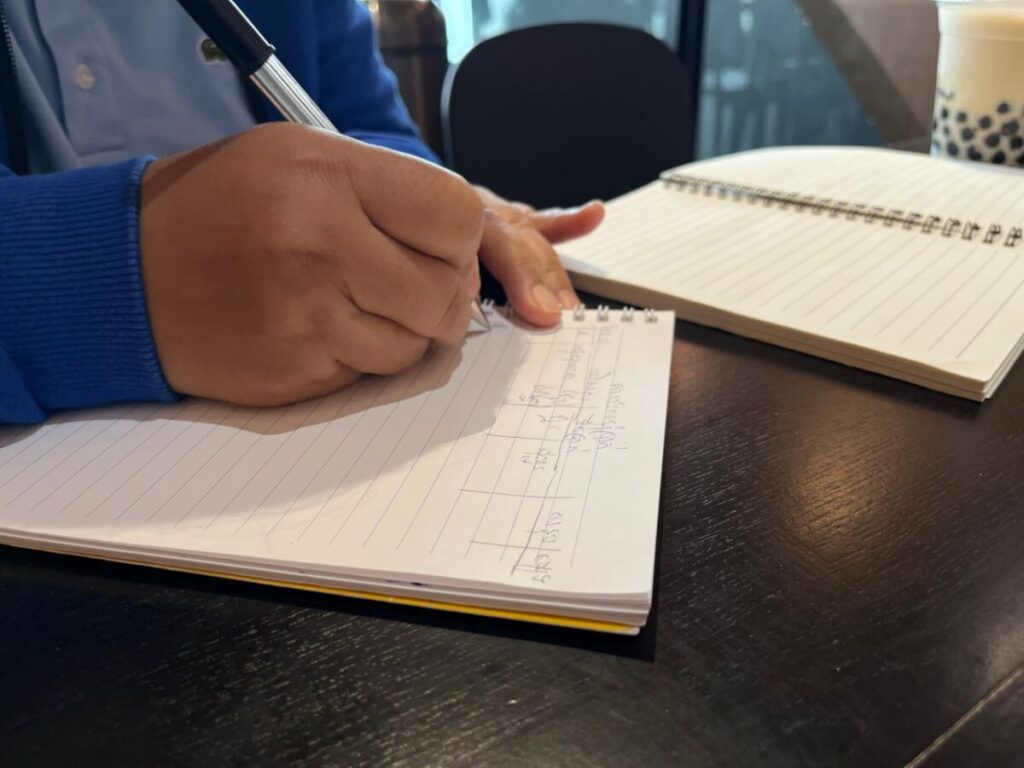

As a teenager in the 1990s, astute savers like Val Kuchphalla had few financial tools available. Personal computers and the internet were expensive and rare, and phone technology remained years away. She relied on pencil and paper.

“I developed my own way with handwritten records, operating like a bank account,” she said. “I tracked deposits and withdrawals, just like a traditional bank book, with dates included.”

Today she is a member of the Lady Saving Group, whose members work to improve the financial literacy of women. Like others, Val Kuchphalla began teaching her children the value of money early on.

As her son and daughter reached school age, she offered them financial incentives to earn good grades. “I promised them 40,000 riel if they ranked in the top three of their class,” she said. “For 4th or 5th place, the reward was 20,000 riel.”

Financial Lessons

Few Cambodians learn about money in school, said Tum Tola, a wealth literacy coach, who explained that most people learn about money management from their parents.

Until recently, the national school curriculum included few lessons on personal finance or financial literacy, topics that many parents view as critical — and a push for greater financial education has been growing in recent years.

In some cases, the private sector has stepped in, partnering with the government to bring money-management lessons to students.

In 2019, the Ministry of Education began working with Prudential Insurance. Through a program called Cha-Ching, children as young as 7 learn the basics of money management. While experts have largely praised the program, they say its limited reach means that many students will graduate without the skills needed to make smart money decisions.

“If people do not understand financial literacy, it doesn’t matter how much money they make,” Tum Tola said. “They will not be able to safeguard their assets or make wise use of their money.”

Topics like investing and borrowing can be complicated, even for skilled financial managers, say experts, and in the hands of novices, poor decisions can have dangerous and long-term financial consequences.

In today’s environment, young people must learn to be self-reliant, said Kaing Tongngy, head of communications at the Cambodia Microfinance Association.

“A child with financial knowledge will not be poor,” he said. “They will know how to use money responsibly, to save, to make money as well as invest.”

For Val Kuchphalla, the mother of two, she believes her lessons paid off. As teenagers, her two children saved enough to buy mobile phones and even a motorbike. Her son graduated from the ACLEDA Institute of Business and her daughter is studying accounting.

Even so, she wonders if formal education in personal money management would have given them a stronger financial foundation. As adults, they make smart decisions and spend cautiously, she said, but like many adult children in today’s economy, they still need occasional financial help from their parents.